Clifton Asset Management Video Case Study

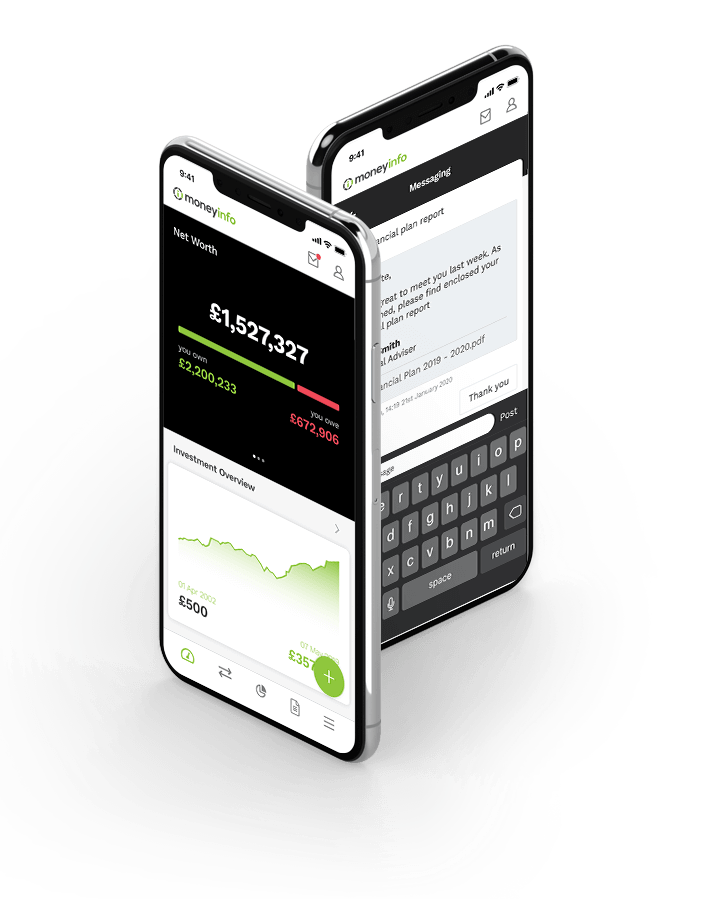

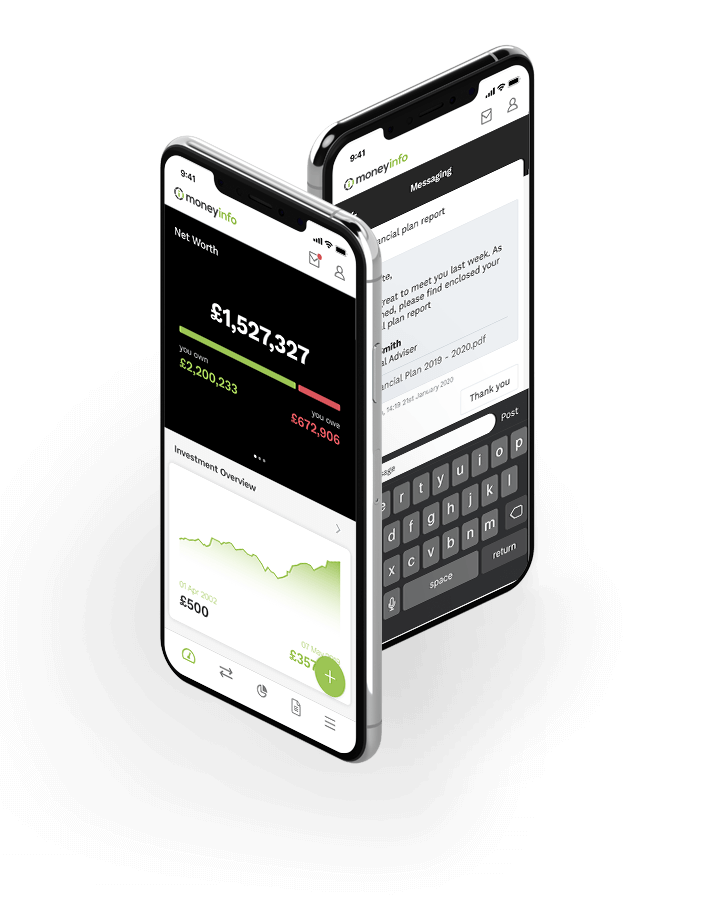

In 2014, Clifton sought a solution that consolidated all of a clients financial information into one accessible portal. moneyinfo provided the ideal technology platform, enabling clients to access real-time valuations and comprehensive snapshots of their wealth from a single interface. This integration eliminated the confusion of multiple third-party environments and simplified complex pension valuations, revolutionising the client experience.

Ten years on, this decade-long collaboration has integrated cutting-edge technology into Clifton’s services, ensuring a seamless, efficient, and secure experience for their clients.

Led by Group Financial Planning Director Anthony Carty, Clifton Asset Management has transformed client engagement through a strategic partnership with moneyinfo. "We wanted really to have a customer journey where they saw everything in one place regardless of who the product provider is." says Anthony Carty.

Clifton’s commitment to innovation is evident in their proactive approach to technology. By implementing moneyinfo’s MyViewpoint portal, Clifton has empowered clients with direct communication channels to their advisers, enhancing engagement and delivering a more personalised financial journey. This forward-thinking mindset has kept Clifton ahead of the competition, continually offering superior service to their clients.

Over the past decade, Clifton has leveraged moneyinfo to efficiently scale their business, particularly through acquisitions. The robust technology stack has facilitated seamless integration and management of increased client numbers, supporting Clifton’s growth and operational efficiency. Automated processes, such as document delivery and valuation updates, have saved thousands of hours annually, allowing the team to focus on delivering exceptional client service.

Clifton’s strategic investment in technology, in partnership with moneyinfo, underscores their dedication to innovation and client satisfaction. This collaboration has not only modernised their services but has also redefined client engagement in wealth management. Clifton and moneyinfo continue to evolve together, setting new standards in the industry and shaping the future of financial advisory services.

Julien Tavener concludes: "Together with moneyinfo, we're not just navigating the future of wealth management; we're redefining it."

If you are a forward-thinking firm who wants to take their client engagement to the next level, find out how you can be part of the growing moneyinfo movement with your own personalised demonstration.

Transcript

Anthony Carty (AC) - Group Financial Planning Director

Julien Tavener (JT) - Head of Client Experience

Tessa Lee (TL) - Managing Director at moneyinfo

Carly Shute (CS) - Head of Proposition

Tom Whitlock (TW) - Head of MyViewpoint

AC: I'm the Group Financial Planning Director at Clifton, and I'm also the CEO of our discretionary fund management business, Eden Park Investment Management.

We took the decision in 2014, here we are, you know, 10 years later, to establish a client portal for two main reasons actually, at the time. We've always been in control of our own tech stack, got our own in-house tech team, our own back office technology. One of the issues we had though, back then, is that in terms of clients receiving or getting valuations, they were disappearing off to third-party environments which, of course, from their point of view, is a bit confusing. So, we wanted really to have a customer journey where they saw everything in one place regardless of who the product provider is. The second reason was that we're a pension provider business, and some of the pensions that we organise for our clients are relatively complex, and getting a valuation for those types of schemes could be hellishly difficult. Our technology basically provided a scenario where we get a consolidated valuation 24/7 delivered via MyViewpoint, which, of course, is powered by moneyinfo.

JT: We are a very forward-thinking business when it comes to technology and, for the past 15 years, quite unusually I think in the financial advisory business, we've built up a standalone technology unit within our company.

TL: As a forward-thinking firm, Clifton Asset Management had a real vision about what they wanted to achieve by implementing our technology to really redefine the way that they engage with their clients and take those clients on their financial journey. They want to stay ahead of the competition; they want to really achieve a better way of doing business with their clients, and for them, it was really important that they chose leading-edge technology that was going to be able to support their business both 10 years ago, today, and hopefully 10 years into the future.

JT: This innovation wasn't just about modernising our services; it was about redefining the way that our clients engage with their financial journey, and a significant part of this transformation has been our collaboration with moneyinfo. Our portal, our MyViewpoint portal and app revolutionise client engagement, offering more than just access to financial portfolios. MyViewpoint empowers our clients with real-time insights and comprehensive snapshots of their wealth, but it also incorporates direct communication channels to their advisers.

AC: The proposition from moneyinfo made complete sense: API driven, plugged into our back office. When you talk to some fairly large firms today, they're still trying to grasp the nettle when it comes to things like client portals, and here we are 10 years in.

CS: I worked on the initial implementation of MyViewpoint with moneyinfo in 2014, so we've been working collaboratively with the moneyinfo team for over 10 years. I also oversee elements of our acquisition process for advisory businesses. The Clifton group has steadily grown over that time, more significantly through the acquisition of advisory businesses over the last two years. Having a robust technology stack, including a client portal, has allowed us to efficiently scale the business to manage increased client numbers. Investing in our technology infrastructure has been a key enabler in growing the business.

AC: We've made six acquisitions since 2019, four of those in the last two years, and we've got a pipeline of further acquisitions which we'll be executing later this year.

CS: MyViewpoint is a key pillar of our service offering and assists us in attracting vendors that wish to sell their business to Clifton and retain clients.

TW: In terms of how much time moneyinfo is saving our business each year, there's the obvious stuff like the automated valuations for our SIP and SAS clients that must at a minimum save at least 2,000 hours per year, and hanging around on the phone or waiting for email responses is pretty frustrating for our admin team as well as our clients. moneyinfo automated all this years ago, and I can't overstate how useful it is for us to have this data updated daily for us and our clients. Then there's the automated document delivery, which saves a huge amount of time automatically delivering reports to clients, including annual valuations and tax reports, and of course our Hubwise documentation, all of which previously we had to deliver via email or via post. With more than 5,000 documents sent per year, the time saved must amount to many thousands of hours, but more importantly, it has stopped any errors in sending the wrong documents to a client. So, using moneyinfo is like having at least an extra two team members prepared to do all the boring bits for us so that we can spend our time concentrating on delivering our outstanding service to our clients.

JT: moneyinfo's cutting-edge technology coupled with robust security measures ensure that our clients' financial information is not only safe but is seamlessly integrated with our advisory services. This partnership has enabled us to offer a service that's not only technologically advanced but also deeply personal and tailored to our clients' needs.

AC: Technology lies at the heart of everything we do at Clifton. It's part of our DNA, and here we are now, 10 years on from 2014. We've very much grown up together, and we will continue to evolve the services that we provide via our client portal to our clients, very much with the help of moneyinfo.

TL: I'm really proud that moneyinfo has been on this 10-year journey with Clifton Asset Management, helping them to evolve their proposition and building fantastic technology that helps them to engage more effectively with their clients and, of course, gives them a better way to do business.

JT: Together, we're not just navigating the future of wealth management, we're redefining it.