Discretionary Fund Managers

A single digital front door for DFM client relationships

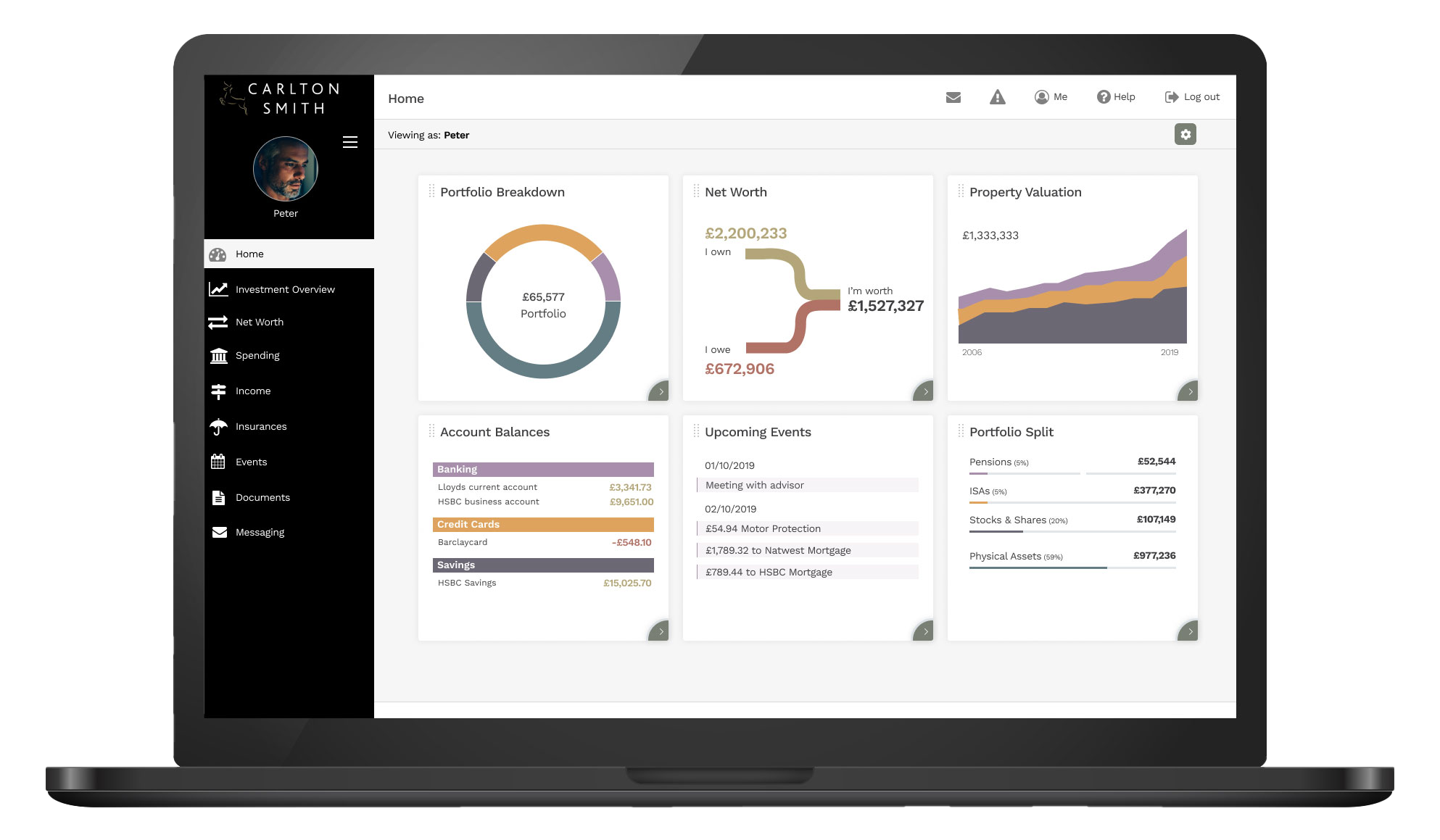

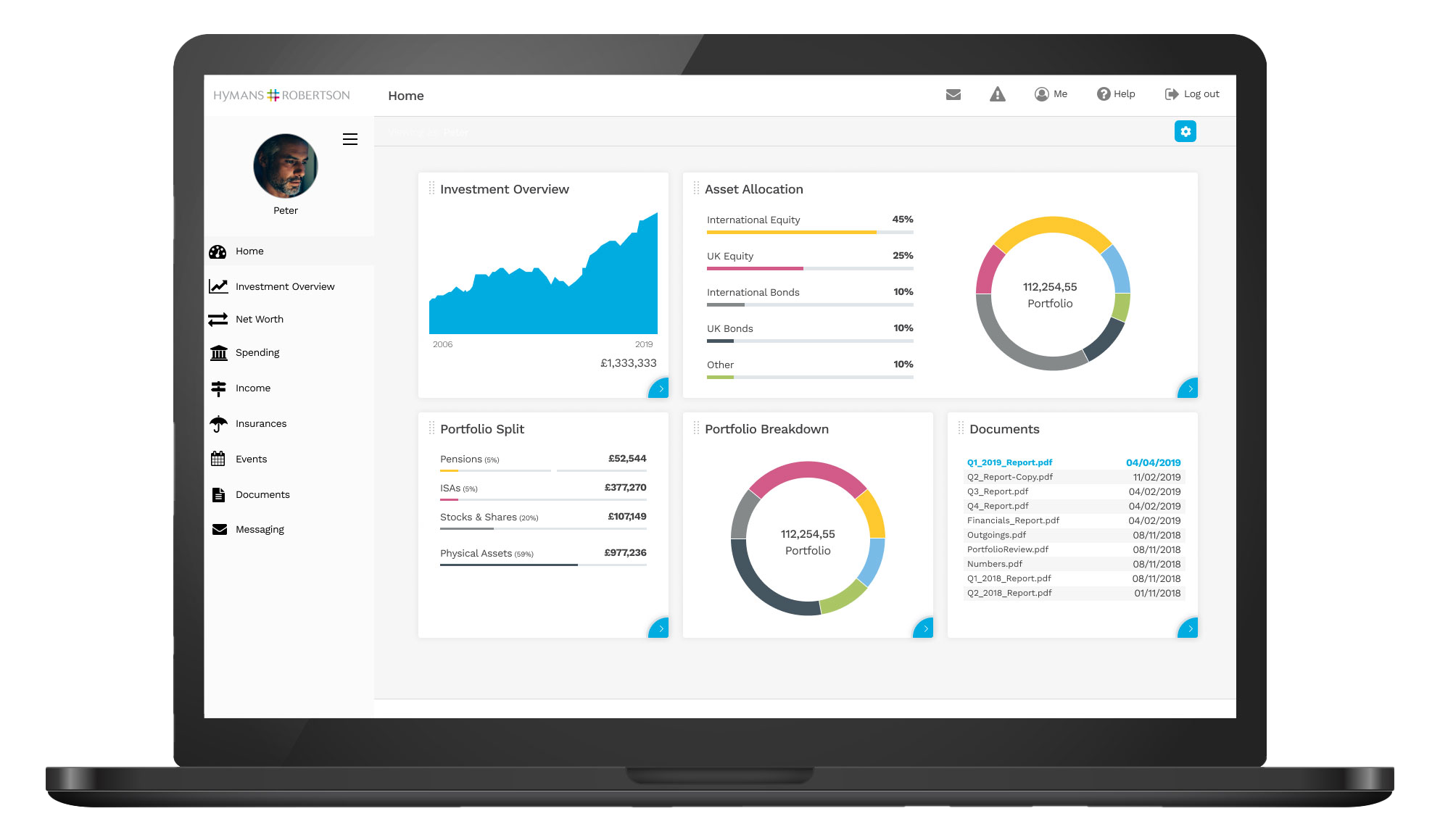

Moneyinfo provides discretionary fund managers with a fully branded client portal and mobile app that becomes the primary channel for client interaction. Investors access valuations, reports, documents and communications in one secure place, while your team maintains full visibility and control.

By sitting on top of your existing investment infrastructure, Moneyinfo simplifies how clients engage with your firm without disrupting portfolio management or trading systems.

Client portals and branded apps for Discretionary Fund Managers

-

Deliver timely, consistent reporting without manual effort.

Moneyinfo integrates seamlessly with leading investment platforms, custodians, DFMs and third party portfolio management systems including Third Financial, IRESS, Pulse, Pershing and IMiX.

These integrations allow discretionary fund managers to automate report delivery across mandates and client segments, ensuring investors always see up to date information without manual reconciliation or spreadsheet driven processes.

-

Reduce friction while maintaining strong governance.

Moneyinfo supports efficient client onboarding and ongoing reviews through structured workflows and a fully customisable KYC process. Information is collected once, stored securely and reused across servicing activities, reducing duplication and administrative overhead.

For DFMs operating at scale, this creates a repeatable, auditable onboarding process that improves speed without compromising oversight or control.

-

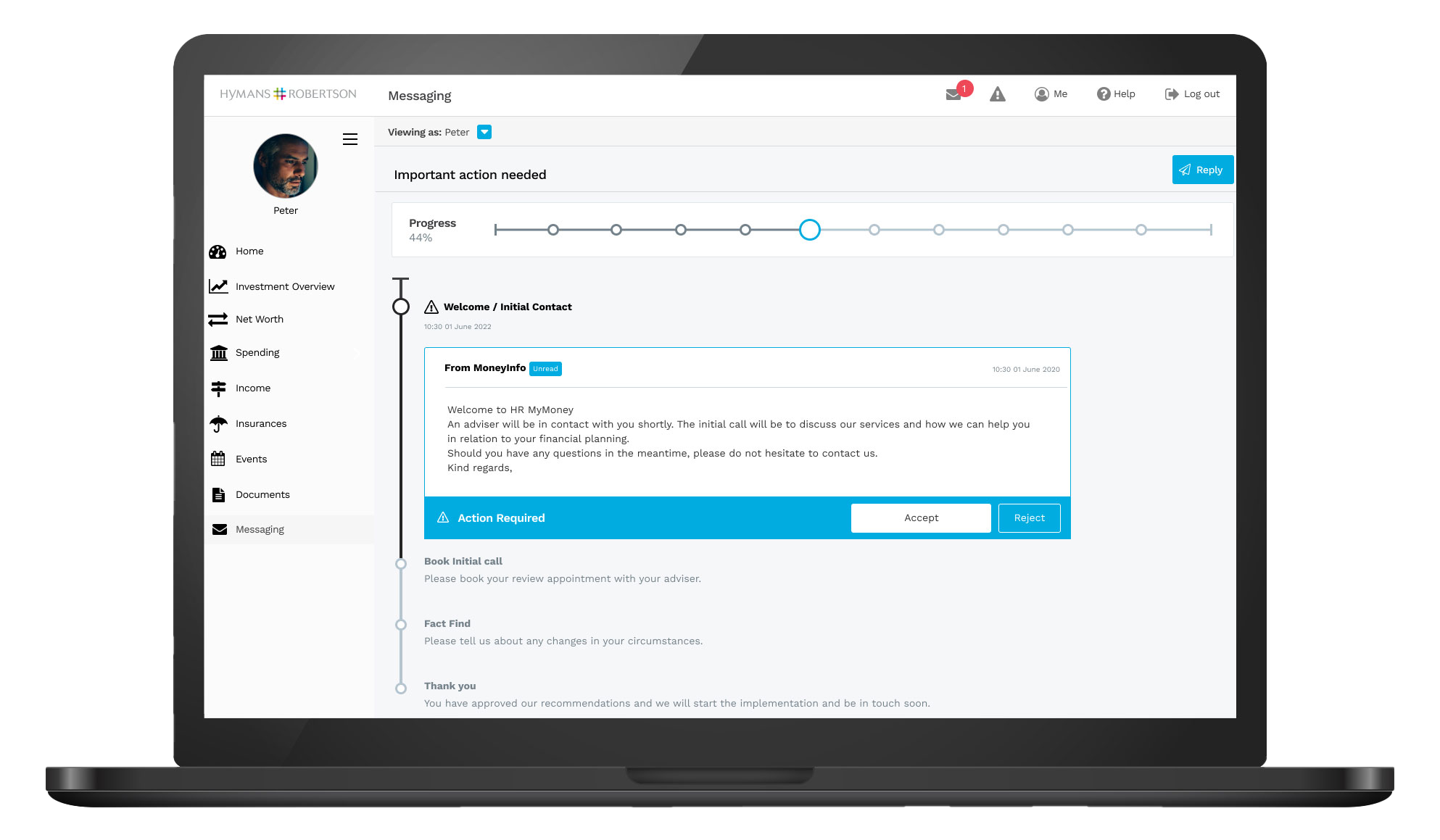

Move away from email and into a governed environment.

Discretionary fund managers face increasing scrutiny around communications, permissions and record keeping. Moneyinfo provides secure messaging, controlled document sharing and detailed activity tracking to support robust governance.

Every interaction is logged, creating a clear audit trail that supports internal oversight, regulatory requirements and risk management, while still delivering a smooth client experience.

-

Support adviser distribution models without increasing complexity.

For DFMs working with adviser firms, Moneyinfo provides a consistent digital experience that works for both intermediaries and end investors. Advisers can securely share information with clients, while DFMs retain control over content, reporting and permissions.

This strengthens adviser relationships, improves transparency and reduces the operational burden of servicing multiple distribution partners.

-

A digital relationship layer designed for DFMs.

Moneyinfo is not a portfolio management system. It is the digital relationship layer that connects your existing platforms, custodians and reporting tools into one coherent client experience.

By integrating with systems such as Third Financial, IRESS, Pulse, Pershing and IMiX, Moneyinfo fits naturally into established DFM operating models while remaining flexible as your business grows.

What Moneyinfo can do for my…

Business

Scaling your firm while delivering exceptional service shouldn't be a challenge. Automating key processes like onboarding, reporting, and compliance tracking saves time and streamlines operations.

Example features:

Clients

Keeping on top of finances is easier with instant, secure access to everything in one place. From biometric login to on-demand valuations, clients can track their wealth whenever they need to.

Example features:

Advisers

Managing clients efficiently means having instant access to the right information. From portfolios and fact finds to audit trails and client tasks, everything is available at a glance.

Example features:

Bringing your brand to life

Frequently asked questions for discretionary fund managers

-

A discretionary fund manager client portal provides investors and advisers with secure access to valuations, reports, documents and communications in one place. It replaces email driven servicing with a structured digital experience that improves transparency and efficiency.

Moneyinfo acts as this digital front door, sitting above existing investment systems.

-

Moneyinfo integrates with leading portfolio management and investment platforms to automate data feeds and report delivery. This allows DFMs to deliver consistent, timely reporting across mandates without manual processing.

Automated reporting reduces operational risk and frees up teams to focus on oversight and client relationships.

-

Yes. Moneyinfo is designed to integrate with the systems discretionary fund managers already use, including Third Financial, IRESS, Pulse, Pershing and IMiX, as well as major investment platforms and product providers.

This means DFMs can enhance client experience without replacing core investment infrastructure.

-

Moneyinfo streamlines onboarding and periodic reviews through structured workflows and a fully customisable KYC process. Information is collected securely, permissions are managed centrally and activity is tracked automatically.

This creates a more efficient process for clients and advisers while maintaining strong governance.

-

Moneyinfo is well suited to DFMs operating through adviser distribution. It provides a shared digital environment where advisers and clients can access the right information, while DFMs retain control over data, reporting and communications.

This improves collaboration and reduces servicing friction across adviser networks.

-

Moneyinfo replaces unstructured email with secure messaging, permission based document sharing and full audit trails. Every interaction is logged and traceable, helping DFMs demonstrate control, oversight and compliance confidence.

This supports regulatory expectations without slowing down client servicing.

-

Moneyinfo is used by discretionary fund managers who want to modernise and own their client experience, improve operational efficiency, and reduce reliance on manual processes.

These firms value scalability, governance and long term flexibility, and are looking for a technology partner that fits into their existing operating model.

Hear what others have to say

You're in good company

Come aboard and let's make the world of financial services more efficient, together.

We integrate with over 50 platforms, back office systems, and collaborative tools

Get in Touch

We understand you want to make sure everything aligns with your needs. Book a free, personalised demo with one of our team members to explore how our solution can help you create a seamless, impactful digital experience for you and your clients.