Multi Family Offices

Deliver a modern digital experience for complex family wealth, without adding operational strain.

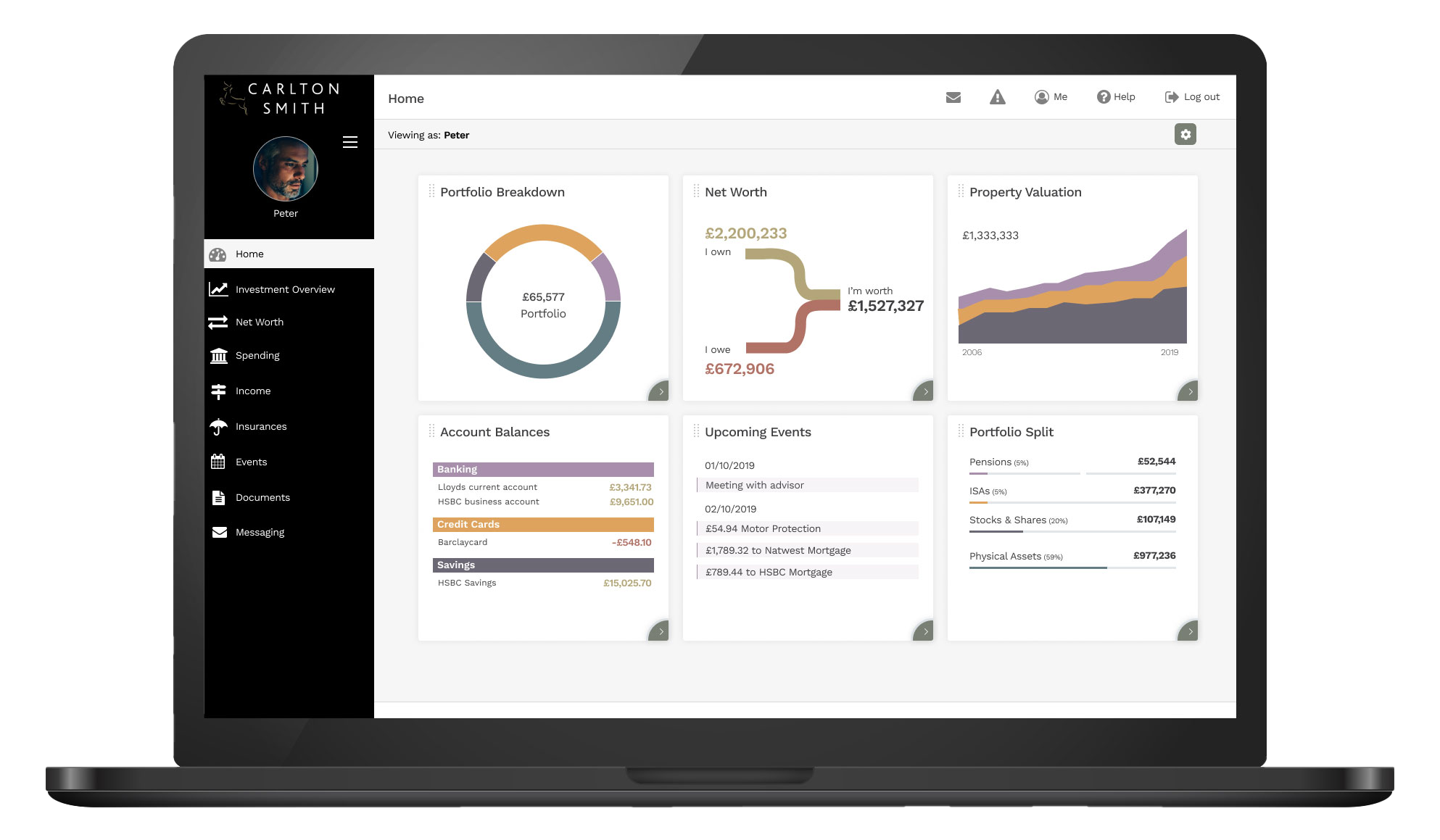

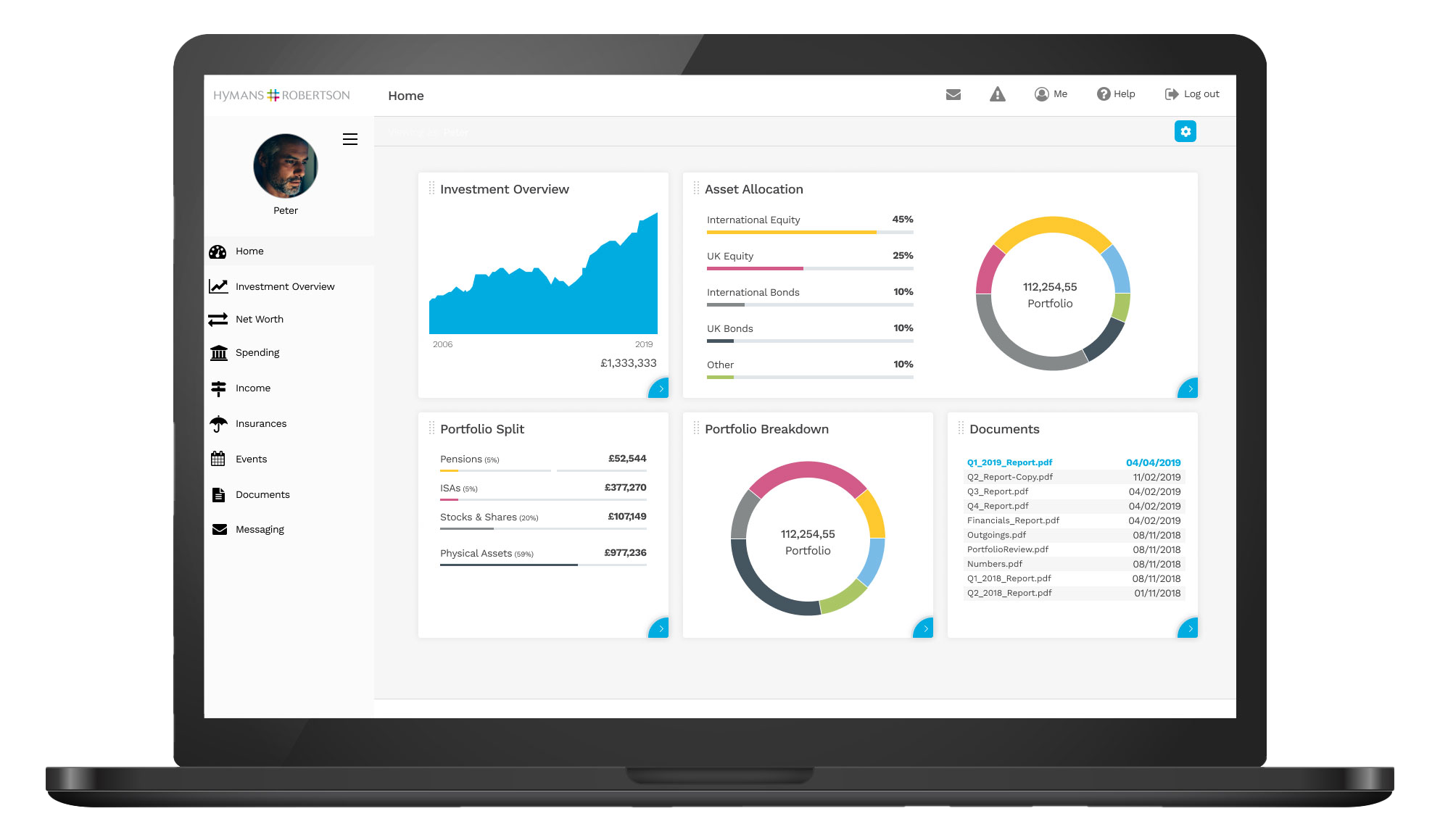

Moneyinfo is a secure, fully branded client engagement platform designed to support the unique needs of single and multi family offices. It gives your team one place to consolidate wealth data, manage communications, streamline servicing and deliver a consistent experience across families, generations and entities.

From onboarding new families to ongoing reporting and secure collaboration, Moneyinfo helps multi family offices transform efficiency and productivity, enhance client experience and engagement, and deliver compliance confidence, all backed by a dedicated and experienced team.

Client portals and branded apps for Multi-family Offices

-

Give families a digital experience that reflects your brand and your service model.

Moneyinfo provides a fully branded client portal and mobile app that becomes the digital front door for your family office. Each family has a secure, personalised space to view consolidated wealth, access documents, complete tasks and stay connected with your team.

For multi family offices managing multiple relationships and structures, this creates clarity and consistency without relying on email or fragmented tools. Clients know where to go, and your team stays in control of the experience.

-

Automated reporting across platforms, structures and asset types.

Multi family offices often manage wealth spread across multiple custodians, platforms and ownership structures. Moneyinfo brings this data together into a single, coherent view through direct integrations with leading investment platforms, DFMs and third party portfolio management systems.

Automated data feeds allow your team to deliver consistent, timely reports without relying on spreadsheets or rekeying. This improves accuracy, reduces operational risk and gives families confidence in the information they receive.

-

Streamline onboarding without compromising governance or client experience.

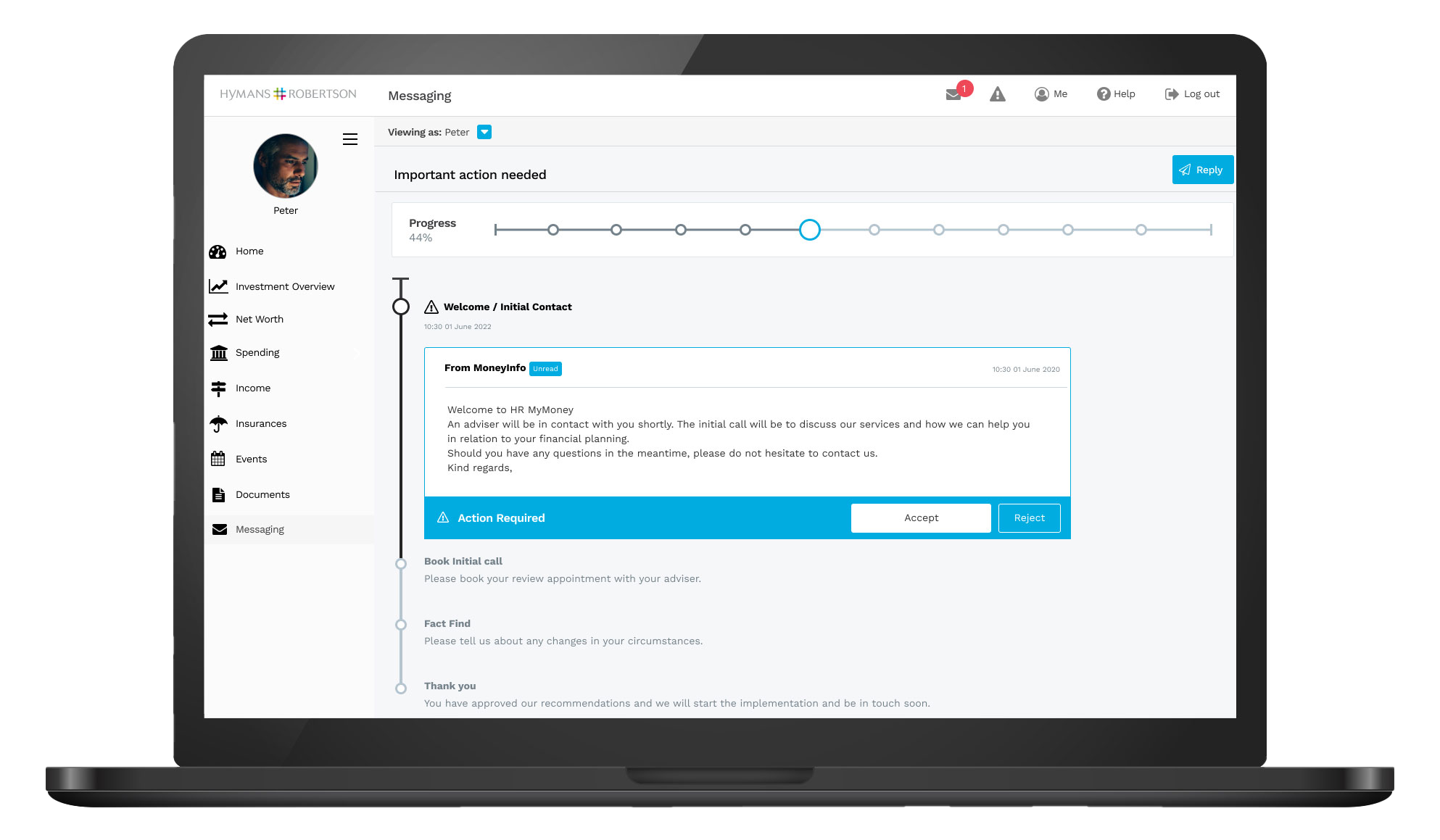

Moneyinfo supports efficient onboarding and periodic reviews through a fully customisable KYC process designed for complex family office environments. Information collection, document sharing and approvals are managed in one secure workflow rather than fragmented email chains.

By integrating with upstream investment platforms and portfolio systems, onboarding data flows naturally into reporting and servicing processes. This reduces duplication, shortens onboarding timelines and gives your team a clear audit trail from day one.

-

Replace email with secure, structured collaboration.

Family offices handle highly sensitive information. Moneyinfo provides secure messaging and permission based document sharing so information is only visible to the right people, at the right time.

All activity is tracked, creating clear audit trails across communications, uploads and approvals. This supports strong governance while making it easier for families and internal teams to collaborate efficiently.

-

Deliver a consistent experience as relationships grow more complex.

As families expand across generations, expectations increase and servicing models become harder to manage. Moneyinfo gives multi family offices a scalable digital framework that supports different client needs without increasing operational overhead.

Automated reporting, structured reviews and centralised communication help maintain a consistent standard of service, even as family structures and requirements evolve.

-

A digital relationship layer that connects your platforms, not replaces them.

Moneyinfo is designed to integrate with the systems multi family offices already rely on. By connecting investment platforms, product providers, DFMs and portfolio management solutions such as Third Financial, IRESS, Pulse, Pershing and IMiX, Moneyinfo acts as the connective layer across your technology stack.

This approach avoids disruption, reduces manual work and ensures your firm remains flexible and future ready as technology and client expectations continue to change.

What Moneyinfo can do for my…

Business

Scaling your firm while delivering exceptional service shouldn't be a challenge. Automating key processes like onboarding, reporting, and compliance tracking saves time and streamlines operations.

Example features:

Clients

Keeping on top of finances is easier with instant, secure access to everything in one place. From biometric login to on-demand valuations, clients can track their wealth whenever they need to.

Example features:

Advisers

Managing clients efficiently means having instant access to the right information. From portfolios and fact finds to audit trails and client tasks, everything is available at a glance.

Example features:

Bringing your brand to life

Frequently asked questions about family office technology

-

A family office technology platform brings together client engagement, wealth reporting, communications and servicing workflows into one secure digital environment. Instead of relying on spreadsheets, email and disconnected systems, family offices use a single platform to manage data, collaborate with clients and deliver a consistent experience across families and generations.

Moneyinfo acts as the digital front door for multi family offices, giving both clients and teams one trusted place to interact.

-

Multi family offices manage complexity at scale. Multiple families, ownership structures, platforms and reporting requirements can quickly create operational strain.

Technology helps by consolidating data, automating routine processes, reducing manual handling and creating clear governance. With Moneyinfo, teams streamline onboarding, reviews and ongoing servicing while maintaining visibility, control and audit trails.

-

Yes. Moneyinfo is designed to support complex family wealth structures, including multiple portfolios, entities and beneficiaries. It integrates with leading investment platforms to deliver consolidated valuations and clear reporting views, even when assets are spread across different providers.

This makes it easier to present meaningful information to principals, family members and advisers without manual reconciliation.

-

Moneyinfo supports both single family offices and multi family offices, with the flexibility to adapt to different service models. Firms can configure branding, permissions, reporting views and workflows to suit how they operate, while maintaining a consistent digital framework.

This makes it suitable for boutique family offices as well as larger firms managing multiple relationships at scale.

-

Clients benefit from having one secure place to access portfolios, documents and communications. Instead of searching inboxes or requesting information repeatedly, families can log in and see what they need, when they need it.

For family offices, this leads to higher engagement, fewer ad hoc requests and stronger long term relationships built on transparency and trust.

-

Security and governance are built into the platform. Moneyinfo provides secure messaging, permission based document access, encrypted data handling and full activity tracking.

This helps family offices protect sensitive information, meet regulatory obligations and maintain confidence in how client data is managed, without compromising usability.

-

Moneyinfo integrates with leading UK investment platforms, back office systems, and technology partners commonly used by family offices. This allows firms to connect existing systems rather than replace them, creating a joined up digital ecosystem.

The result is less duplication, cleaner data and a more efficient operating model.

-

Moneyinfo is used by forward thinking family offices and multi family offices that want to modernise their client experience, improve operational efficiency and reduce reliance on manual processes.

These firms value control, clarity and long term scalability, and are looking for a technology partner rather than a standalone tool.

Hear what others have to say

You're in good company

Come aboard and let's make the world of financial services more efficient, together.

We integrate with over 50 platforms, back office systems, and collaborative tools

Get in Touch

We understand you want to make sure everything aligns with your needs. Book a free, personalised demo with one of our team members to explore how our solution can help you create a seamless, impactful digital experience for you and your clients.